Payroll & Tax Filing

Whether you just need in-house software or full payroll processing, Basic Payroll has a solution for every employer.

At Basic Payroll, we know that as a business owner or HR Professional, employee payroll processing and tax reporting can be the headache that never goes away. We also know that accuracy on both fronts is the only way to keep your employees content and your business free from penalties and fines. That’s why we pride ourselves on offering customized payroll services and timekeeping solutions for any type of employer.

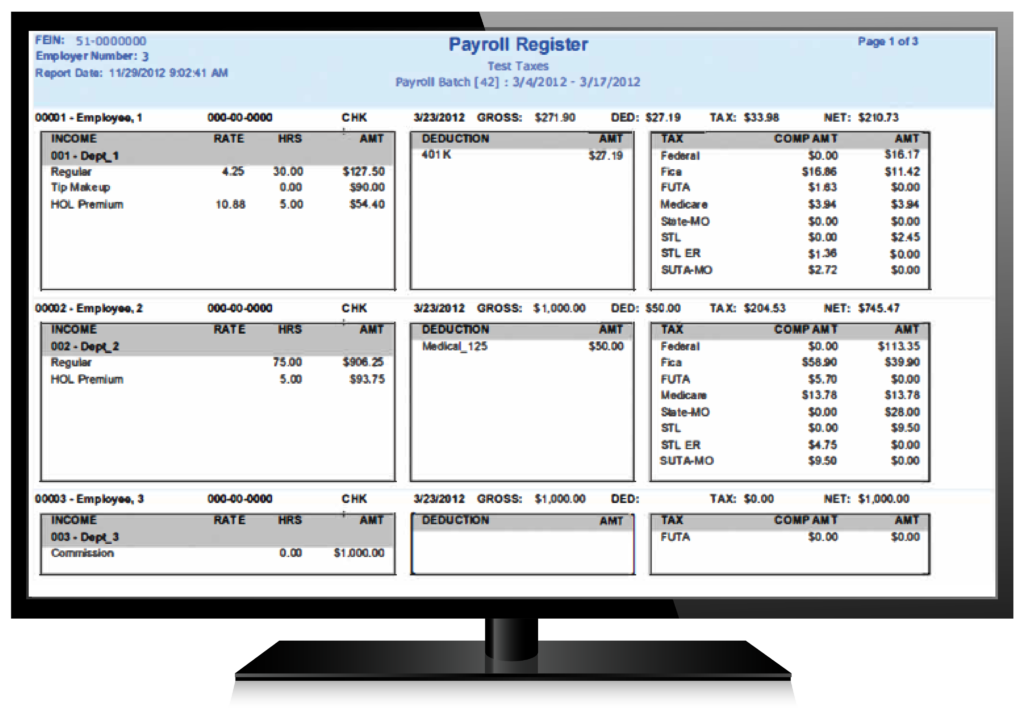

Gatekeeper: In-House Payroll Processing Software

Our Gatekeeper software delivers the technology and support to collect, manage, and organize the data to process payroll efficiently and accurately—a cost-effective alternative to outsourcing payroll. Our proprietary in-house payroll software is configured to meet your company rules and to comply with federal, state, and local taxes to correctly pay employees for time worked. As a standalone in-house payroll that interfaces with all major general ledger accounting systems, or integrated with the Gatekeeper time and attendance system, you have the tools and reporting necessary to process a simple or complex, multi-location payroll.

- Internet browser-based access

- Users are always on the latest version

- Tax tables automatically updated

- Unlimited incomes and deductions

- Pre and Post Processing Alerts

- Compliant with garnishment rules

- Email option for direct deposit voucher

- Integrated with accounting G/L

- Federal and State quarterly and EOY reporting

- Integration capability with a variety of payroll and ERP systems

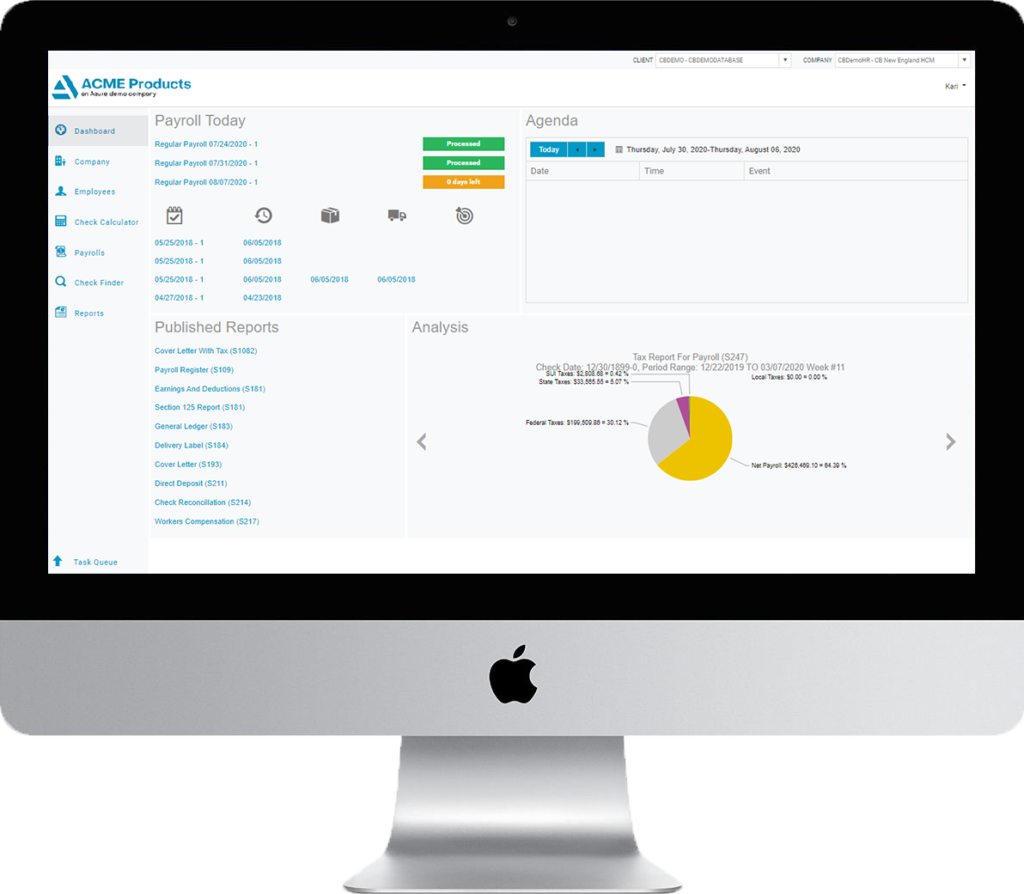

Payroll Plus: Outsourced Payroll Processing Administration

Lack of expertise and poor customer service are the main reasons employers look to make a payroll provider change. Luckily for you, there’s no need to suffer another year. At Basic Payroll, we pride ourselves on helping employers needing to replace their payroll company at any time throughout the year. Payroll Plus Administration understands everything that’s riding on your payroll and relieves your burden by increasing accuracy, saving time, ensuring compliance, and reducing costs.

- Designed to scale with the growth of your business

- 150 standard reports built-in plus custom reports via our Report Writer

- Automatic transfers

- Electronic tax filings

- Virtually paperless system that offers unlimited options including direct deposit, earnings, deductions, shifts, pay rates and localities

- Special requests such as workers’ compensation audits, internal analysis, mailing lists or company logo/signature

- Employee Portal provides employees 24/7 access to personal data, pay information, W-2s, and time-off accrual information

- Single Sign-on capability with Basic Payroll Timekeeping and HCM solutions

Benefits of Gatekeeper Payroll Software

Gatekeeper’s payroll for in-house processing is complete from new hire W-4 to end of the year W-2, and all requisite state and federal tax reporting. It is fully integrated to our time and attendance module, and interfaces with all major general ledger accounting systems. This open communication promotes seamless integration across divergent platforms, saving valuable time and eliminating data entry-related errors.

- Apply complex business rules, streamline payroll, and maintain compliance with tax authorities

- Helps mid-level private and public sector companies manage labor costs and maximize profits

- Built-in best practices for tax & ACA compliance and efficiency

- Track affordability for health care under the Affordable Care Act

Benefits of Payroll Plus Administration

When it comes to managing employees, nothing is more important than making sure their paychecks are accurate and delivered on time. With Payroll Plus, your business can rest easy knowing your employees’ paychecks are being handled on the industry’s leading payroll and tax engine. Beyond paying employees, keeping up with the ever-changing federal, state, and local payroll taxes can be a complex and time-consuming task, but with Payroll Plus integrated Tax Management engine you can rest assured your business will remain in compliance.

- Scalability to handle clients of all sizes and complexity levels

- One of the most secure, auditable platforms on the market

- Built-in best practices for tax & ACA compliance and efficiency

- Ability to go paperless with automated pack-out and delivery

- Our tax professionals research and maintain federal, state, and local tax rates,tax brackets and statutory limits so you can concentrate on growing your business